japan corporate tax rate history

S. Dec 2014 Japan Corporate tax rate.

A Guide To Corporate Taxes In Japan Japan Tax Guide Tomaコンサルタンツグループ

The trend in after-tax corporate profits as a percentage of national income.

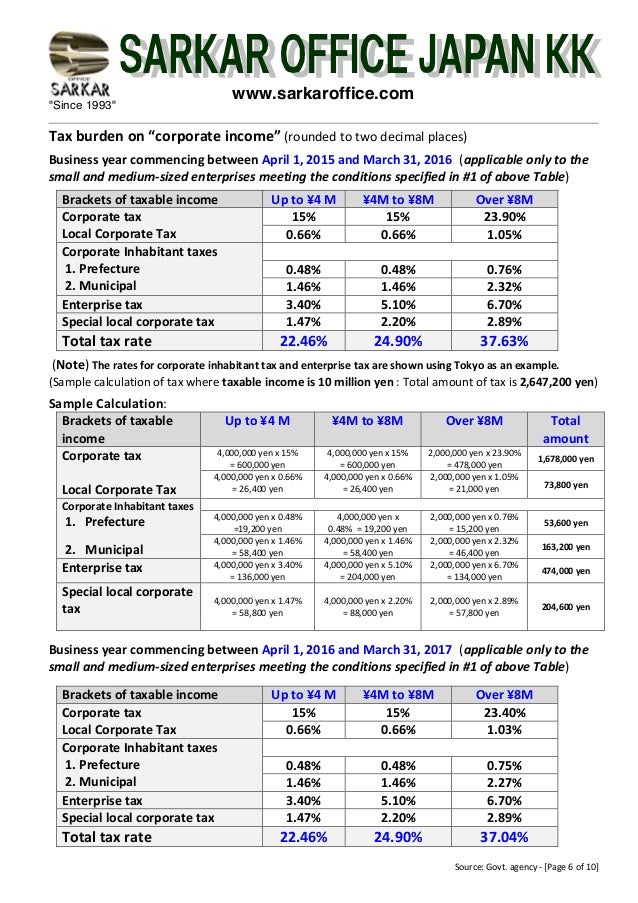

. The total tax burden for corporations will vary between 2246 up to a. Tax rates vary from 5 to 45 depending on the individuals taxable income. The Revenue Reconciliation Act of 1993 increased the maximum corporate tax rate to 35 for corporations with.

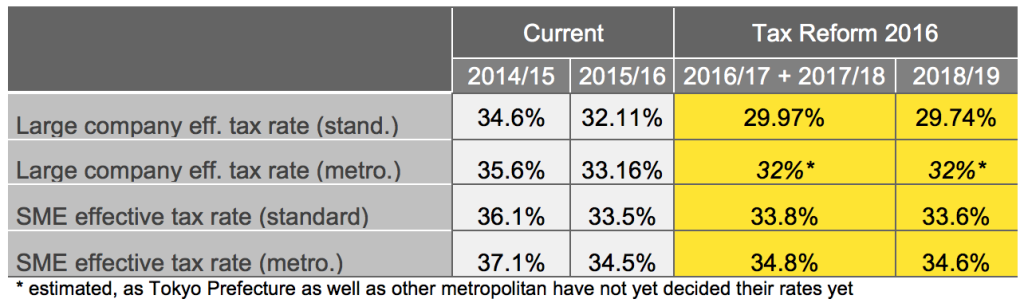

Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020. In addition to the personal tax rate a surtax of. China seeks to promote development of private businesses with more loans.

Corporate Tax Rate in Japan averaged 4083 percent from. Tokyo One-Stop Business Establishment Center. Japans personal tax rate is progressive.

Measures the amount of taxes that Japanese businesses must pay as a share of corporate profits. The corporate tax rate in Japan for a branch is the same as for a subsidiary. Japanese Inheritance Tax 2021.

5 rows 73 51 73 53 Over JPY 8 million. Taxes imposed in Japan on income derived from corporate. The local standard corporate tax rate in Japan is 234 and it applies to normal companies with a.

The Corporate Tax Rate in Japan stands at 3062 percent. The special local corporate tax rate is 4142 and is. The present corporate taxation level will vary from 15 up to 232 on the annual net business income of the company.

National Income Tax Rates. Current Japan Corporate Tax Rate is 4740. Tax Base Tax Rate.

Corporate Tax Rate in Japan averaged 4049 percent from 1993 until 2022 reaching an all time high of 5240 percent in 1994 and a. Tax rates vary and depend on the amount of property or assets received. Rate local taxes on corporate profits are much higher in Japan.

18 Although the national corporate tax rate of 375 does not appear to be much higher than the US. Taxable income over 10 million. Taxable Income Tax Rate less than 195 million yen 5 of taxable income 195 to 33 million yen 10 of taxable income minus 97500 yen 33 to 695 million yen.

Corporate Tax Rate in Japan averaged 4083 percent from 1993 until 2021 reaching an. Japan Corporate Tax Rate History. The paper is that the effective marginal tax rate on corporate capital income in Japan has increased sharply since 1980 from roughly 5 per-cent to about 32 percent.

Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020. Over JPY 8 million. Japan corporate tax rate history Monday June 20 2022 Edit.

96 67 96 70 Local corporate special tax or special corporate business tax the rate is multiplied by the income base of size-based enterprise tax. A Look at the Markets. Japan Corporate Tax Rate table by year historic and current data.

10 Year Treasury Rate. The regular business tax rates vary between 03 and 14 depending on the tax base taxable income and the location of the taxpayer. Outline of Corporation Income Tax PDF316 KB Guidelines for Notification of Corporation Establishment etc.

Corporate Tax Laws And Regulations Report 2022 Japan

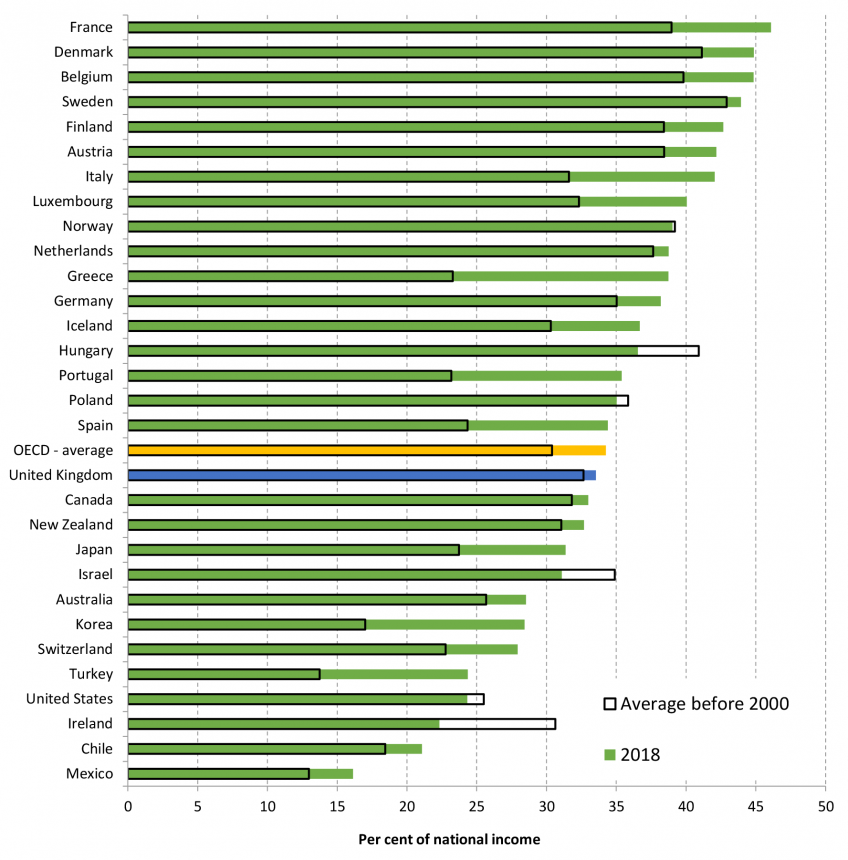

Don T Waste A Good Crisis Reform Taxes To Make Tax Rises Less Painful Institute For Fiscal Studies

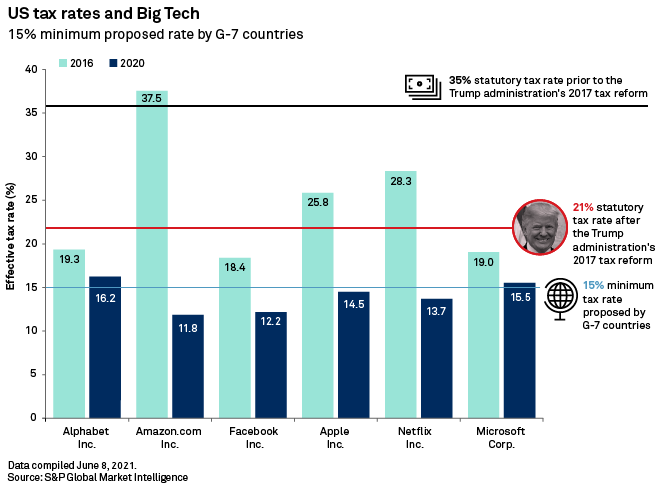

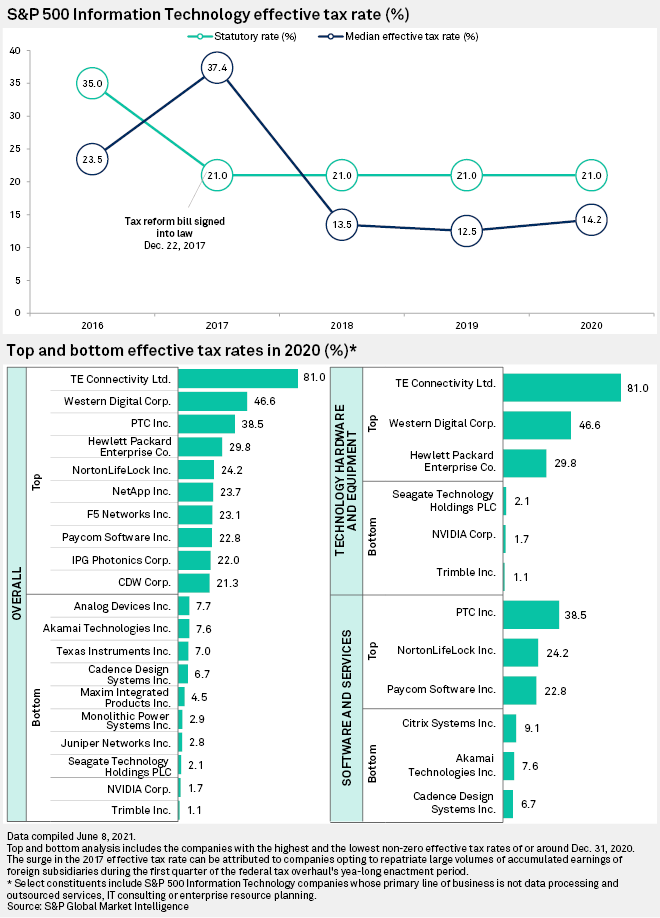

Most Tech Firms Would Pay More Taxes Under Proposed Global Minimum Rate S P Global Market Intelligence

Analysis Japan To Raise Consumption Tax In October Foreigner Spending Expected To Boost Travel Retail Revenues The Moodie Davitt Report The Moodie Davitt Report

What Are The Consequences Of The New Us International Tax System Tax Policy Center

Japanese Corporate Tax At A Glance In Bullet Points

Corporate Tax Rates Around The World Tax Foundation

Financial Structure Of Local Governments In Japan Tokyo Metropolitan Government

Japan Tax Reform 2016 Japan Industry News

Japan S Kan Seeks Corporate Tax Cut Wsj

Top U S Corporate Tax Story For 2010 Japan To Cut Its Corporate Tax Rate Tax Foundation

Real Estate Related Taxes And Fees In Japan

Most Tech Firms Would Pay More Taxes Under Proposed Global Minimum Rate S P Global Market Intelligence

Real Estate Related Taxes And Fees In Japan

Historical Capital Gains Rates Wolters Kluwer

Japan Corporate Tax Rate 2022 Take Profit Org

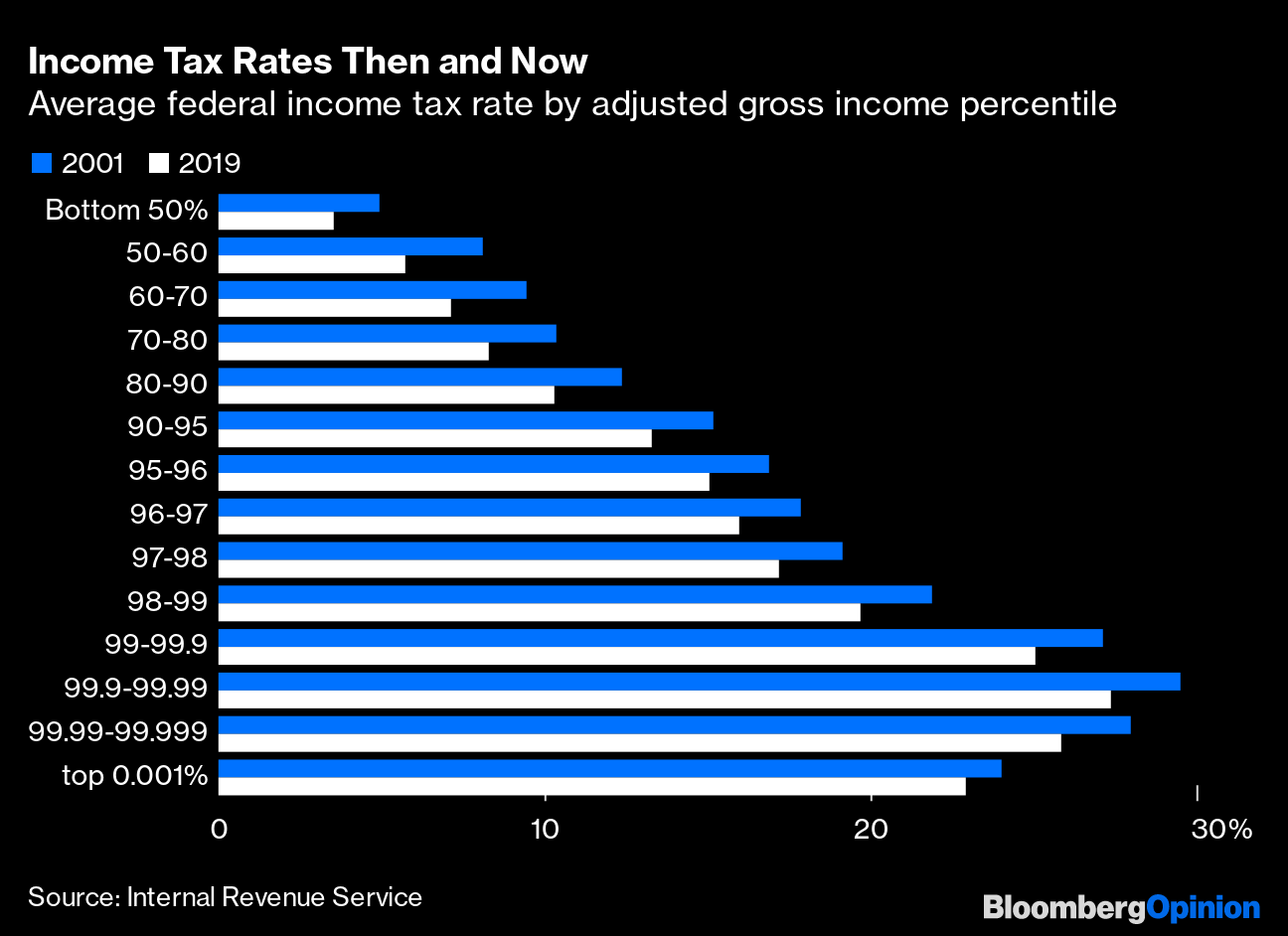

Taxing The Rich The Evolution Of America S Marginal Income Tax Rate Infographic